Incorporating a Private Limited Company in India is one of the most popular and secure structures for startups, SMEs, and growing businesses. We often advise clients that registering a company is not just a legal requirement—it’s the first formal step in building a compliant, credible, and scalable business.

Whether you’re a first-time founder or an experienced entrepreneur, here’s a detailed yet simplified guide to help you navigate the incorporation process under the Companies Act, 2013.

A Private Limited Company is one of the most popular business structures in India. It provides limited liability, separate legal entity status, and better credibility.

Whether you’re a first-time founder or an experienced entrepreneur, here’s a detailed yet simplified guide to help you navigate the incorporation process under the Companies Act, 2013.

In this guide, you will learn step-by-step how to register your company.

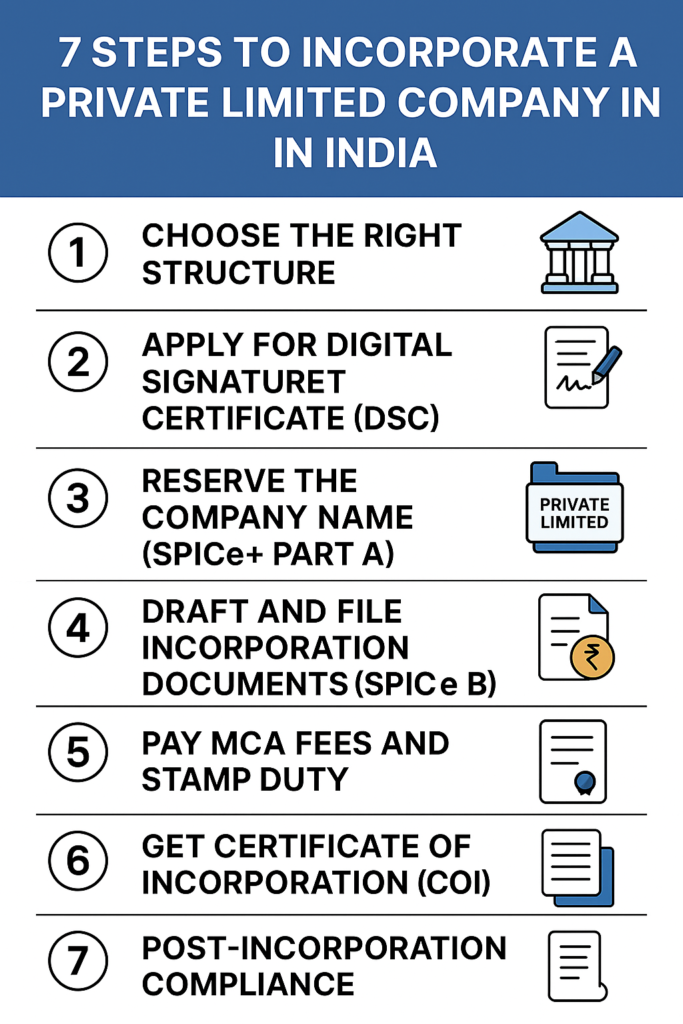

Step 1: Choose the Right Structure

Before incorporation, ensure that a Private Limited Company is the right fit. It is ideal if:

- You want limited liability protection.

- You’re planning to raise equity funding.

- You want a separate legal identity from the owners.

- You have at least two directors and two shareholders

Step 2: Apply for Digital Signature Certificate (DSC)

All proposed directors must obtain a Digital Signature Certificate (DSC) from a licensed Certifying Authority. This is essential for signing documents electronically.

📌 Tip: Keep scanned copies of PAN, Aadhaar, Passport-size photo, and email & mobile ready.

Step 3: Reserve the Company Name (SPICe+ Part A)

Use the SPICe+ Part A form on the MCA portal to apply for name reservation. Ensure:

- The name is unique.

- Ends with “Private Limited”

- Doesn’t infringe on existing trademarks

💡 You can check name availability on MCA and also conduct a trademark search.

Step 4: Draft and File Incorporation Documents (SPICe+ Part B)

Once the name is approved, fill SPICe+ Part B with the following attachments:

- MOA (Memorandum of Association)

- AOA (Articles of Association)

- AGILE PRO (GST, EPFO, ESIC, bank account & professional tax registration)

- INC-9 (Declaration by subscribers)

- DIR-2 (Consent from directors)

- Utility bill & NOC from property owner (for registered office)

Step 5: Pay MCA Fees and Stamp Duty

The filing fee and stamp duty vary depending on the state and authorized capital. For most startups with ₹1 lakh authorized capital, total government charges are nominal.

Step 6: Certificate of Incorporation (COI)

If all documents are in order, MCA usually issues the Certificate of Incorporation (COI) within 3–5 working days. This includes:

- CIN (Corporate Identity Number)

- PAN and TAN (auto-generated)

- GSTIN if applied via AGILE PRO

Step 7: Post-Incorporation Compliance

After incorporation, ensure the following:

- Open a current bank account.

- Issue share certificates within 60 days.

- File Form INC-20A (Declaration of Commencement of Business).

- Appoint an auditor within 30 days.

- Start bookkeeping and annual compliance tracking.

- Open a current bank account.

Final Thoughts from ANK Legal Sahara.

Incorporation is the foundation—compliance is the key to sustainability. A well-structured private limited company not only builds trust but also makes due diligence, fundraising, and governance seamless.

At A&K Legal Sahara, we guide you from incorporation to full compliance, allowing you to focus on growing your business while we manage the legal and regulatory landscape.